Section 3 of the Income Tax Act 1967 ITA states that income shall be charged for the income of any person accruing in or derived from Malaysia or received in Malaysia from outside MalaysiaThe phrase accruing in or derive from Malaysia means the source of income must be in Malaysia. This Act may be cited as the Finance Act 2021.

How Much Does It Cost To Develop A Law Firm Mobile App Development App Development Mobile App Development Happy Students

You are non-resident under Malaysian tax law if you stay less than 182 days in Malaysia in a year regardless of your citizenship or nationality.

. Pre-existing disparities in wealth are exacerbated by tax policies that reward investment over waged income subsidize mortgages and subsidize private sector developers. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. No changes in tax treatment.

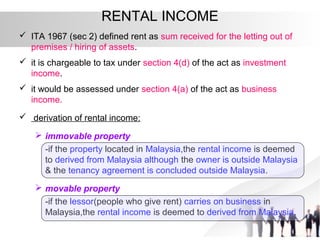

1 The income of any co-operative society-a in respect of a period of five years commencing from. In this regard the Guidelines may be reviewed from time to time. Rental income is filed under Section 4d of the Income Tax Act 1967.

Adherence to the Income Tax Act 1967 the Act and Inland Revenue Board of Malaysia IRBM procedures as well as domestic circumstances. The Prime Minister made a televised statement announcing the dissolution of the 12th Parliament at 1130 am local time the same day. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally.

If investment property IP is used as an IB building provided under paragraph 63 Schedule 3 of the Income Tax Act ITA 1967 paragraph 60 Schedule 3 of ITA 1967 is applicable. Tax Act 1967 the Labuan Business Activity Tax Act 1990 the Promotion of Investments Act 1986 the Finance Act 2012 and the Finance Act 2018. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income of any person accruing in or derived from Malaysia.

Deleted by Act 328. The Malaysian Insight file pic August 8 2022. 3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment.

Today Sime Darby employs over 21000 people enjoys pre-tax profits in excess of US120 million and achieves a 14 percent return on shareholders equity. The company operates such diverse businesses as plantations and estates agricultural equipment distribution commodities trading and related businesses in finance and insurance. With effect from YA 2004 foreign source income derived from sources.

If youre renting a property for business purposes however your rental income is filed under Section 4a. The individual has been. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967. B those emoluments are payable from the public funds of that country and subject to foreign tax of that country. A 2-month extension for filing of income tax returns due between March 2020 and June 2020.

Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. Shahrir 72 is charged with money laundering by not stating his real income in the Income Tax Return Form for Assessment Year 2013 which is a violation of Section 1131a of the Income Tax Act 1967 on the RM1 million believed to be from unlawful activities which he received from. Form BE refers to income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business.

Following the dissolution of Parliament a general election. Due to concerns raised by various parties on the possible ramifications of removing the exemption for FSI remitted to Malaysia the Ministry of Finance MoF had on 30 December 2021 announced that this exemption from income tax will be given by concession for a period of five 5 years. Countries that regulate access to firearms will typically restrict.

A 2014 meta-analysis of racial discrimination in product markets found extensive evidence of minority applicants being quoted higher prices for products. Such income under. The Malaysian Parliament was dissolved on 3 April 2013 by Tuanku Abdul Halim the Yang di-Pertuan Agong on the advice of the Prime Minister of Malaysia Najib Tun Razak.

Form BE refers to income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. Notwithstanding the aforementioned the arms length principle remains as the guiding principle throughout the Guidelines.

In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. With effect from 1 January 2009 a withholding tax mechanism to collect withholding tax at 10 on other types of income of non-residents under Section 4f of the Income Tax Act 1967 has been introduced. Amendment of Acts 2.

The Income Tax Act 1967 Act 53 the Real. Short title and commencement 2. Gun laws and policies collectively referred to as firearms regulation or gun control regulate the manufacture sale transfer possession modification and use of small arms by civilians.

Employed on board a Malaysian ship. This exception will not apply if the Labuan entity has made an irrevocable election to be taxed under the Income Tax Act 1967 in respect of its Labuan business activity. Charge of income tax 3 A.

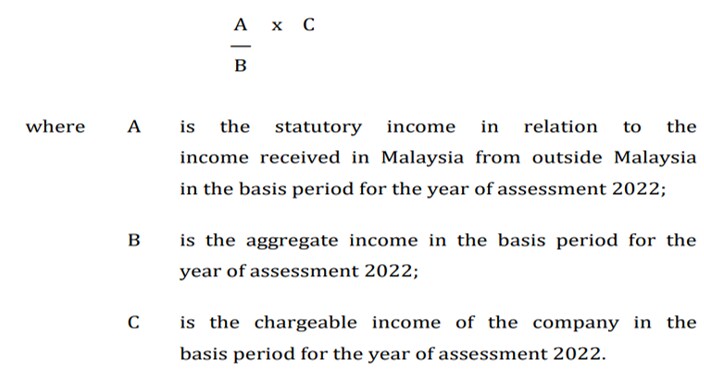

Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. MoFs Announcement on Tax exemption for FSI on 30 December 2021. The relief is restricted to the lower of Malaysian tax payable or foreign tax paid if there is a treaty or one-half of the foreign tax paid if there is no treaty.

Laws of some countries may afford civilians a right to keep and bear arms and have more liberal gun laws than neighboring jurisdictions. Income attributable to a Labuan business activity of a Labuan entity including the branch or subsidiary of a Malaysian bank in Labuan is subject to tax under the Labuan Business Activity Tax Act 1990 LBATA. Depreciation and impairment loss are to be added back.

Under Part II Section 7 of the Income Tax Act 1967 the Malaysian government considers any individual regardless of their nationality a tax resident if the individual fulfils any of the underlying conditions. The owner of the building is entitled to Industrial. A tax deduction for donors who donate to either the Ministry of Healths COVID-19 Fund.

ENACTED by the Parliament of Malaysia as follows. Income under Section 4f refers to gains and profits not covered under Sections 4a to 4e of the Income Tax Act 1967. 1 This Act may be cited as the Income Tax Act 1967.

It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer. The National Disaster Management Agencys COVID-19 Fund. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property.

Chapter i PRELIMINARY Short title 1. Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. A Labuan entity can make an irrevocable election to be taxed under the Income Tax Act 1967 in respect of its Labuan business activity.

Non-resident individual is taxed at a different tax rate on income earnedreceived from Malaysia. Non-chargeability to tax in respect of offshore business activity 3 C. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1.

Or one of the institutesorganisations approved under s446 of the Income Tax Act 1967.

Income Tax Act 1967 Pages 251 300 Flip Pdf Download Fliphtml5

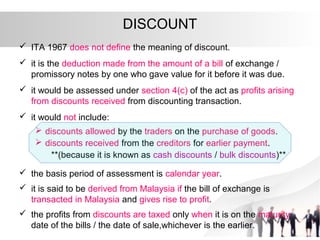

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 1967 With Complete Regulations And Rules 10th Edition

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment Semantic Scholar

Laws Of Malaysia Income Tax Act 1967 Revised 1971

Librarika Income Tax Act 1967 Act 53

Malaysia Income Tax Act 1967 Laws Of Malaysia Online Version Of Updated Text Of Reprint Act 543 Studocu

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Taxation Principles Dividend Interest Rental Royalty And Other So

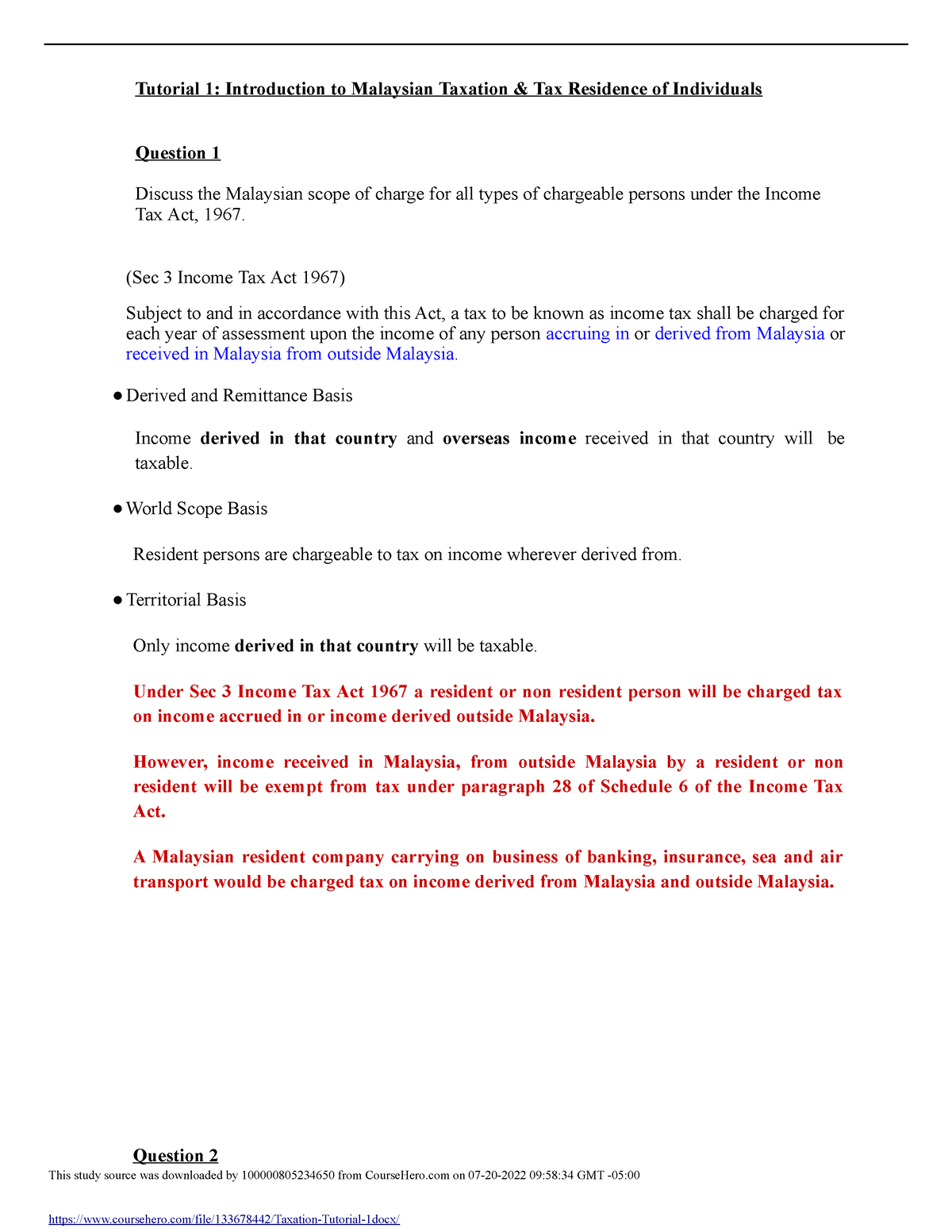

Tutorial 1 Tutorial 1 Introduction To Malaysian Taxation Amp Tax Residence Of Individuals Studocu

Buy Income Tax Act 1967 Act 53 With Selected Regulations Rules As At 10th April 2022 Law Books Malaysia Joshua Legal Art Gallery

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment Semantic Scholar

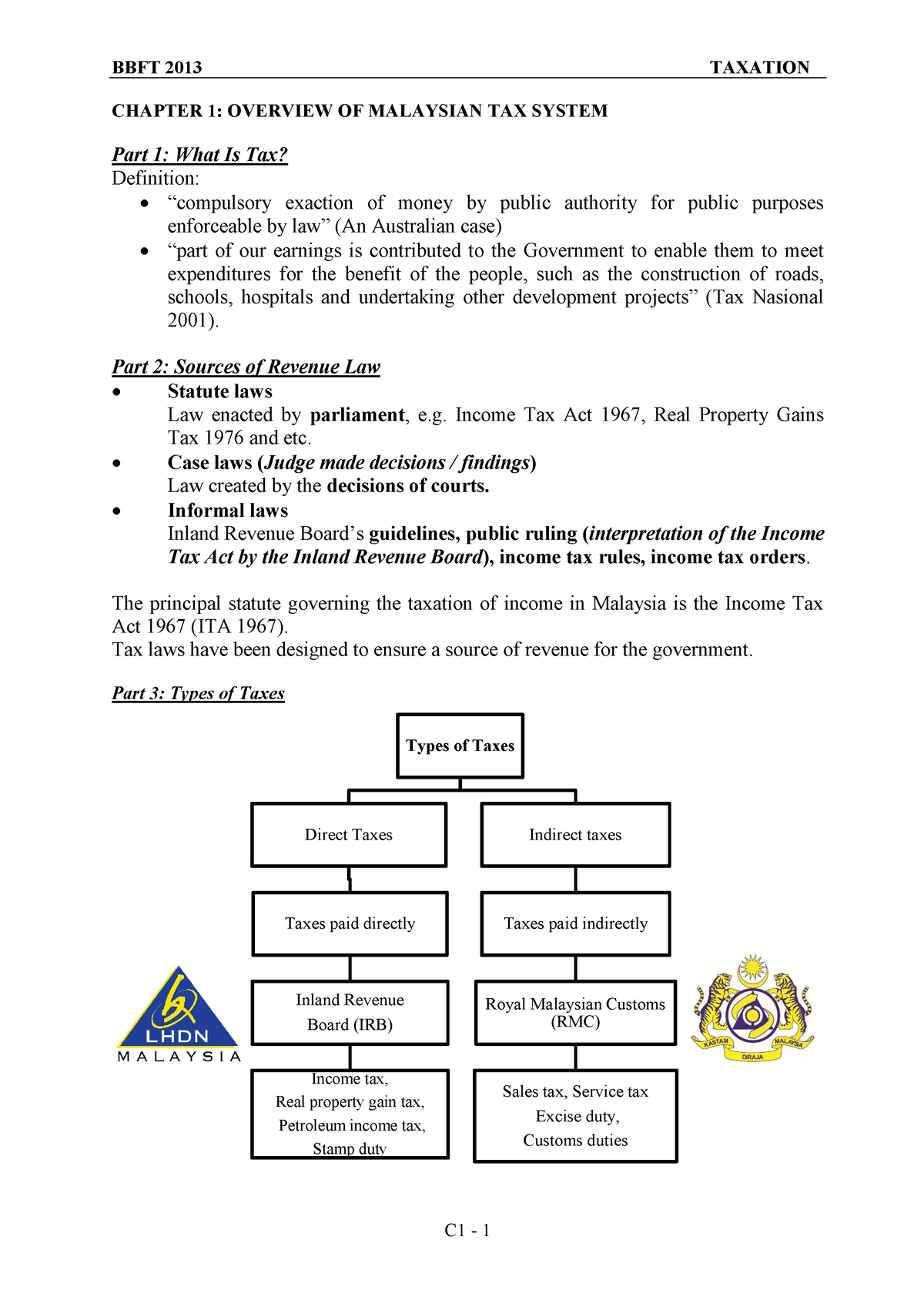

Chapter 1 Overview Of Malaysian Tax System Chapter 1 Overview Of Malaysian Tax System Part 1 Studocu

As An Employer What Are Their Obligations In Terms Of Income Tax

Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com